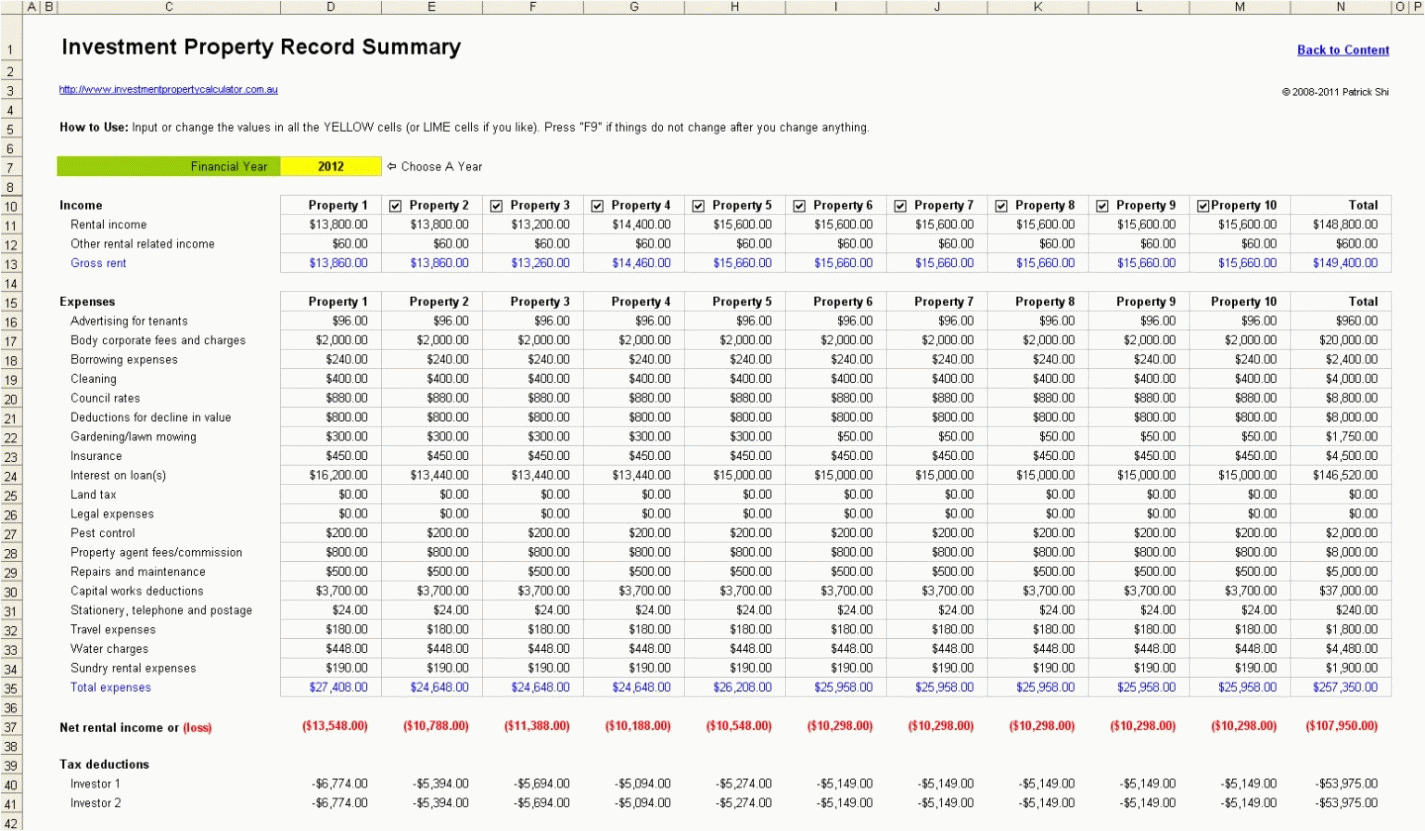

Information will be much more accurate, and you’ll receive tips on ways to increase your revenue that many investors may overlook. The P&L – or profits and loss statement – is a financial report that lists income, expenses, and profit (or loss) from a rental property over a specific period of time.Įven if your real estate business is brand new and you currently own just one rental property, consider using a free online software system such as Stessa to easily track property finances and performance. It’s always a good idea to use more than one method to estimate expenses in order to get a balanced view of the actual ownership costs. Here are four ways you can accurately determine rental property expenses.

Look for costs that can be cut or potential maintenance expenses you may want to add to help increase the value of your investment.

If you’re buying a rental property from an online marketplace such as Roofstock, you already have an accurate idea of what the rental property expenses were for the previous owner.īut even with the seller’s profit and loss statement in hand, you should still analyze the property’s operating expenses.

RENTAL PROPERTY TRAVEL EXPENSES HOW TO

How to Determine Rental Property Expenses In this article, we’ll explain how to accurately determine rental property expenses, list the common expenses of owning a rental property, and look at one of the best ways to track rental property expenses online for free. Where many people make their mistake is my underestimating the true cost of owning and operating an investment property. Most real estate investors do a pretty good job of estimating the gross rental income a property can generate.

0 kommentar(er)

0 kommentar(er)